Buying Investment Property – What is a “Good” deal?

Let’s look at a tried and true way to measure rental property investment returns and what we as buyers should be looking for in our purchases. Total investment returns in real estate are really comprised of two pieces: operating positive cash flows and long-term appreciation. In today’s world, even though it probably will come, we cannot count upon and should not consider long term appreciation. That leaves positive operating cash flows as our primary source of investment return. Let’s call this: “earning money the old fashioned way.”

So how do we calculate our returns and how do they compare to other investments where we could place our hard earned cash equity dollars? It is quite straightforward to calculate our investment returns, unfortunately few people do this leaving many a buyer to make poor real estate choices.

Most Important – “Cash on Cash return” is the most important measurement. So while the price is important, one’s actual cash equity investment is the vital issue. So for every dollar invested what is our percentage yield return on our equity cash investment. CDs offer 1.5%, Bonds 4.5%, stocks 7.5% and real estate is generally high risk, so we want fairly high returns to compensate for the risk.

If one is buying a $200,000 investment property they probably put down 25% or $50,000 plus another 5% or $10,000 for closing costs, loan fees and rehab costs. So the mortgage is $150,000 and a buyer’s cash equity is $60,000 from the start. Again: The property price of $200,000 is important too, but how much cash equity one invests is much much more important.

If one is buying a $200,000 investment property they probably put down 25% or $50,000 plus another 5% or $10,000 for closing costs, loan fees and rehab costs. So the mortgage is $150,000 and a buyer’s cash equity is $60,000 from the start. Again: The property price of $200,000 is important too, but how much cash equity one invests is much much more important.

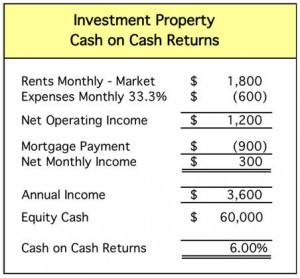

See Chart – Using a conservative estimate, depending on the local market, that property might generate $1,800 per month in rent and have 33.3% operating expenses ($600) leaving net operating income of $1,200. Then subtracting the monthly mortgage payment of $900 leaves $300 of monthly cash flow or $3,600 per year.

Divide that $3,600 by the $60,000 of cash equity and this property has a first year cash on cash return of 6.0%. And it should increase a little each year as rental income increases, as do general expenses, but the mortgage stays constant.

That 6.0% is a pretty fair return for real estate and of course there hopefully will be some long term appreciation, tax benefits and a little more yield from the mortgage balance pay down via amortization of the loan.

Be Smarter – It is stunning how many real estate buyers fail to do this simple calculation and buy properties with minimal or negative cash on cash returns – to their own financial detriment. Let’s be a little bit smarter and make sure we take a good look and a conservative approach to real estate investing for our own long term benefit.

Go for the Cash Flow! – As a final note, buyers will find prize properties, like at the beach or fancy condos, generally have very low or negative returns. Skip those! It is the moderately priced units that have decent cash on cash returns. Hence… “prize” properties are NO prize…moderately priced cash flowing properties are the real prizes! Then you will have to figure out where to invest all that positive cashflow….

Leonard Baron, zillow.com “Read Full Story”

At Gay Real Estate, we keep you posted about all the residential real estate news affecting the LGBT community coast to coast, and in your neighborhood.

Click here for list of gay realtors, lesbian realtors and gay friendly realtors Nationwide.

If you have a real estate story that you’d like to share with us with the LGBT community, please contact us at: manager@gayrealestate.com